Guide to Value Pricing for Accountants

Guide to Value Pricing for Accountants

I have good news and bad news if you’re using the billable hour model for your accounting business. The bad news is that you’re practicing a model of business that is oppressive, suffocating, and of your own doing (yes, it may sound harsh but it needs to be said).

The good news is that I’ve been in that hole before, and I know the way out. Let me introduce you to the Guide to Value Pricing for Accountants.

As you read the content below, it’s going to seem, at times, uncomfortably familiar. I too spent a large portion of my career as an accountant buying into the (so-called indisputable) fact that part of my profession meant chasing billable hours, working into the night, and struggling with clients to pay me for work I had already completed. Straight up…this is a fallacy and I’ll show you why!

Now onto the practical Guide to Value Pricing for Accountants.

Table of Contents

What are the Two Types of Billing Models Accountants Use?

Before we get into why value pricing is the best model for your accounting firm, let’s review the billing models accountants generally use first.

The Billable Hour Billing Model

I’ve written an entire blog post about the billable hour which exhausts all the reasons why it is an outdated and archaic model which you can read about in detail here.

To refresh your memory for those who aren’t clear on this mode, billable hours are the amount of time in hours a firm spends working on a client’s file that are charged to said client at an agreed-upon hourly rate. Written as a simple equation, Price = Time x Rate.

Value Driven (Value Pricing) Billing Model

We will go into more details and the concept of value pricing throughout this blog post but the simple equation for value pricing is Price < Value.

With value pricing there are multiple ways to go about determining the pricing:

- Agreed amount at the end

- Monthly subscription model

- % of Upside / Deal

- Combination of the above

A Staggering Prediction About the Future of Accounting

Before we dig into the value pricing model, let’s stop for a moment to discuss the future of the accounting profession.

We can easily look to the past to see where entire industries have been wiped out—almost to the point of extinction—because of this lack of vision to which everything was heading. Trends on how customers want to consume products or services can’t be ignored.

Did you know that there is an indisputable likelihood that accountants’ jobs will be replaced by robots/artificial intelligence in the future?

Go to www.replacedbyrobot.info to search for yourself. Simply enter in a job title and it will give you the percentage likelihood that the job will be replaced by robots. Let me give you the results…

100 % Chance of Automation – “Accountants” will definitely be replaced by robots.

The website is based on a 2013 Oxford Study by Carl Benedict Frey and Michael Osborne entitled The Future of Employment: How susceptible are jobs to computerization (I’ve attached the PDF link here for those who want to read the entire study.)

As accountants, we have been in a very stable and secure profession for as long as we can remember. People have always needed us to prepare their financial statements and file their taxes. As much as we complain about the difficulties of having to stay on top of the latest complex tax rules, these complexities have actually given us a safety net when it comes to outside competition and our client’s reliance on us. As such, we’ve become complacent, assuming our profession is safe and secure.

Artificial Intelligence in the Accounting Profession

With the coming wave of artificial intelligence (AI), the accounting profession is going to experience major disruption in the future. What was once a stable and secure profession is now on shaky ground. We have already seen the first signs of this tsunami with online tax preparation software and bookkeeping services. Automated auditing programs are already displacing the need for professional staff at the largest accounting firms around the world. Soon to follow will be the use of AI programs to help analyze and provide guidance and planning solutions for all areas of our client’s needs.

AI is coming, and it’s going to change our view of the world yet again. It has the power to eliminate entire market segments, and many people will find themselves out of a job. Even accountants.

Block Chain Technology

Block Chain has taken automated bookkeeping software advances and made them look like a beginner’s game. Where the ease and convenience of automated bookkeeping software functions has reduced the need for human labour, Block Chain has opened up the potential for completely eliminating the need for it altogether.

What is Block Chain anyway? According to Investopedia, a blockchain is a digitally distributed, decentralized, public ledger that exists across a network.

In simple terms, Block Chain technology is a digital ledger in which economic transactions are recorded both chronologically and publicly. It was originally created for managing digital currency transactions, but its application is finding its way into many other areas. Unlike traditional accounting software that only records one party’s side of the transaction (for example, the purchaser), Block Chain records both sides (purchaser and buyer).

Picture a world in which all transactions are not only permanently recorded, but are automatically verified by all parties in the transaction. Putting effort into ensuring your client’s books and records were correct will be replaced with a “real-time” verifiable and incorruptible ledger. There’ll be no question whether your client actually bought that piece of machinery. If it’s in the Block Chain, it happened.

What does this mean for the future of the profession? It doesn’t take much of a stretch to envision a world ledger where all transactions are automatically populated without our help. Governments could have access and be able to audit (in real time) all economic transactions in their constituents’ businesses. Gone are the days of needing a third-party intermediary (like a chartered accountant) to pull together the financial information necessary to file tax returns. In this article, Deloitte is already calling Block Chain technology a “game-changer for accountants.”

Okay, so now I’m certain I’ve lost some of you. I’m sure you’re saying, “This all sounds really interesting but you’re painting a future where Big Brother is watching everything that we do. You’re going off the deep end into science fiction.” Maybe I am, or maybe I’m not. The point of this discussion isn’t to get into a debate over the future but rather get us thinking about where everything is headed. To survive in this business, you need to not only keep your eye on today’s activities, but you also need to keep your eye on the ball of what’s likely coming. Preparation and adoption is key to survival. Resistance is futile.

So naturally, the question must be asked ”What can we do to protect ourselves from these changes?”

The Answer: “Move yourself up the Value Curve.”

“THE ACCOUNTING PROFESSIONAL IS GOING TO EXPERIENCE MAJOR DISRUPTION IN THE FUTURE. GET AHEAD OF THIS CHANGE AND POSITION YOURSELF FOR SUCCESS BY MOVING UP THE VALUE CURVE.”

Now, you may be wondering:

- What is the Value Curve?

- Why is it so important to the Accounting Profession?

- How do I move up the Value Curve?

We’ll explore these questions and more below.

What is the Value Curve for Accountants?

I was first introduced to the Value Curve over ten years ago during my search for a new way of doing business. I found it while reading an insights paper created by Ric Payne, the co-founder of Results Accountants’ Systems and he has very graciously given me permission to use his illustration to share with you (thank you Ric!). The Value Curve highlighted an essential key to what was happening to me and so many other accountants, worldwide. This key to a successful accounting firm business model may seem like common sense once we discuss it. The real trick, however, is applying this common sense to produce better results.

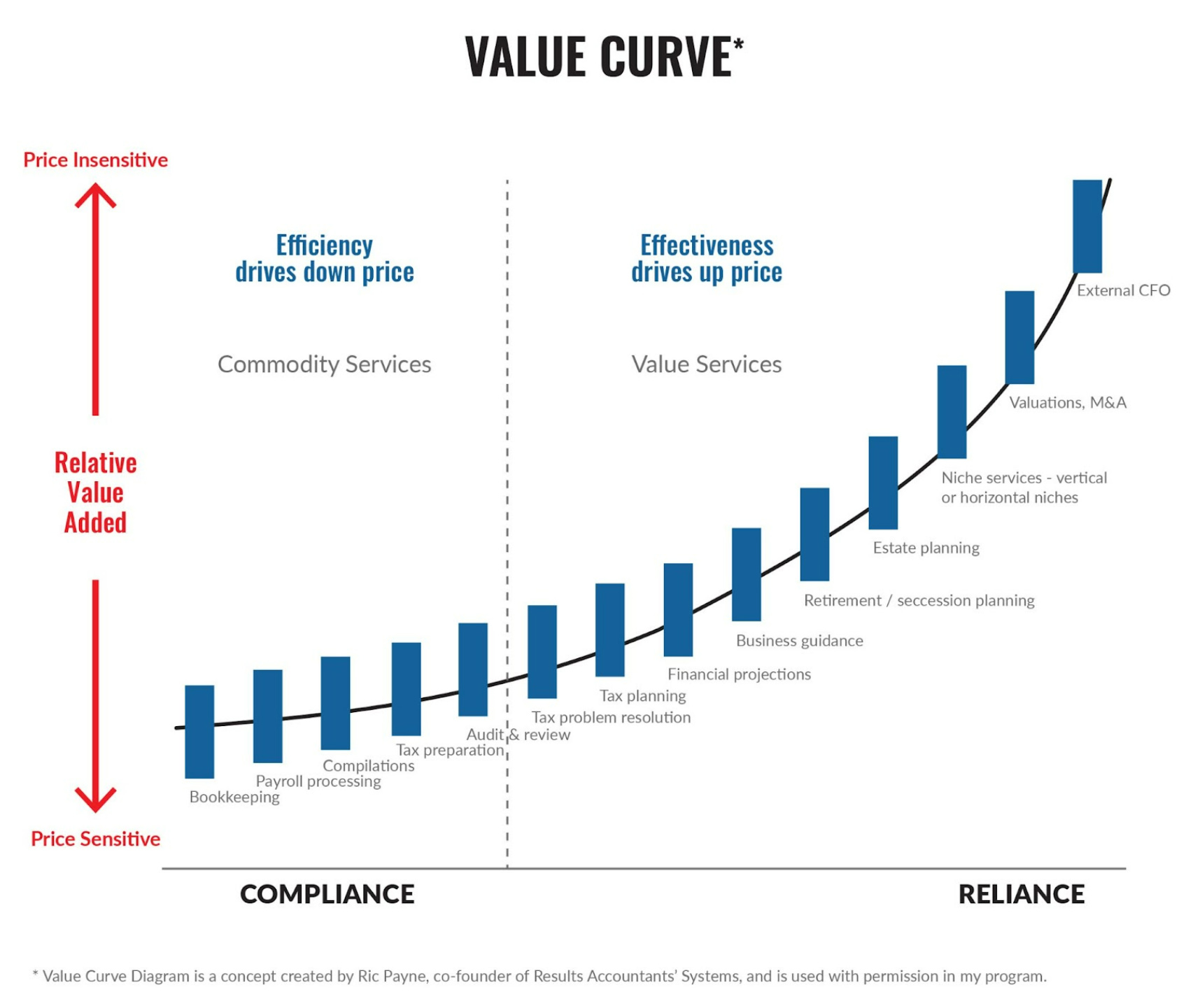

The Value Curve illustrates the interaction between the type of services you provide relative to your clients’ price sensitivities. It also shows how increases in efficiency drive down price, whereas increases in effectiveness drive up price.

See the Value Curve table as it relates to the Accounting Profession.

Key Items:

Value Curve = Services Provided

Horizontal Axis = Compliance (Commodity Service) vs. Reliance (Value Added Service) Vertical Axis = Client’s Price Sensitivity

Efficiency vs. Effectiveness as it relates to Price

The services provided on the left-hand side of the curve are the most price sensitive in the eyes of our clients, whereas the services provided to the right are less price sensitive.

The positioning you want to be taking is that of services provided on the right side of the curve. These services have upward pressure on price, because your clients value these services so much more. These services are effective in providing the real value your clients want. You can charge higher prices, and your clients will gladly pay for them (especially the farther right you go on the curve).

At some point in our careers, most of us have found that the most price-sensitive services we provide are those that are perceived as simply compliance-based. Whenever we get to work on projects that are further to the right of the curve, we are able to charge much more with less resistance from our clients.

What I find interesting is that most accounting firms are consumed with increasing efficiencies. Why aren’t we looking to be more effective? That’s where the best value is for our clients, and it commands the highest price we can receive for our services.

What is Value-Based Pricing vs the Value Curve?

Value-based pricing is actually based on the value curve. It’s how you position yourself to bundle various services for your specific client for a set amount that is fixed and agreed to prior to working with the client in earnest. Value-based pricing allows you to move away from the old billable hour model and move towards providing maximum value (refer to the value curve again) for your client. This will ultimately increase your revenue, and decrease your hours and in turn, this frees you up to spend more time improving your accounting business.

If you aren’t yet persuaded on the merits of value pricing, I’d like to point you in the direction of the godfather of value pricing, thought leader and author Ron Baker. In the Future Firm Accounting Podcast, Ron was asked about his definition of value pricing and he said “Value Pricing is charging a price commensurate with the value you are creating for your customer.” To learn more about Ron check out some of his great posts at the VeraSage Institute here.

Key #1: Maximize Your Revenue Per Accounting Client by Providing Services Higher Up the Value Curve

One last time, let’s refer back one more time to the staggering prediction that accountants will be replaced by AI. As such, it logically stands that services that are compliance-based will be the first to fall to the wave of AI. They are perfectly aligned to be the first to be automated by the sheer fact that they are compliance-based. We already see this happening with these services today (online bookkeeping/tax services etc.). They are being performed more efficiently through technology and subsequently, prices are going down.

ACCOUNTANTS FOCUS TOO MUCH OF THEIR ENERGIES ON BEING MORE EFFICIENT WITH THEIR WORK. THE REAL KEY TO SUCCESS IS BECOMING MORE EFFECTIVE.

Now, let’s play this movie forward. If your accounting practice is heavily weighted in compliance-based services, then you are going to feel more and more downward pressure on fees as the AI efficiency improves. As your fees drop, you will be forced to increase your number of clients to compensate for your reduced rates. I’m not sure if there’s a more dreaded concept to any accountant than having to prepare MORE tax returns every year just to maintain their revenue levels! Ugghhh.

You shouldn’t try to compete on price. Instead, you want to compete on value. Accounting firms need to move up the Value Curve by providing greater value and charging better prices. This will keep you from falling into the commodity business model trap and keep you ahead of the AI disruption.

Key #2: Services Higher Up the Value Curve are Further Away From the First Wave of AI Disruption.

Some Accountants May Think They Already Do This…

Some accountants may think they’re already providing services that are higher up the Value Curve. They may believe that their clients already consider them to be their #1 Trusted Advisor and come to them for these types of services. Everyone thinks they are unique and not the same as other accountants. But if we look carefully, we will often see that this isn’t the case.

In reality, most accountants focus the bulk of their practice on low-hanging fruit. The compliance-based filings are our bread and butter. But as we now know, in the not-too-distant future, this fruit is going to dry up and won’t feed us the way it used to. As such, providing higher-value services have not been the norm for us — they have been the exception. They are the limited and infrequent special projects that come along sporadically, giving us a nice kick to our revenue position. Deep down, many of us wish we had more projects like this and more often.

I hear accountants continually talk about looking to provide value-added services to their clients, yet somehow it doesn’t seem to happen. Or if it happens, it’s not consistent. This is because we’re too busy trying to get all the other work done that we currently have on our plates. We can’t even focus on the bigger picture.

Now that we know how the Value Curve works, doesn’t it seem crazy not to leverage it? Why don’t we actively go after this work all the time?

Positioning the Services of Your Accounting Firm

It all comes down to how you position your firm, yourself, and the services you provide. It’s all very well to say that you offer all of the services higher on the Value Curve, but no one will buy them from you unless you sell them on it.

As accountants, we are not used to the idea of having to sell our services. But it’s a critical step if you want to be really successful.

So, how do you start giving clients higher-value services?

Position Yourself as Your Client’s External CFO (Financial Quarterback)

First, change your mindset. I suggest you position yourself as your clients’ Financial Quarterback. You want them to think of you as their external CFO, not just their accountant. You want to automatically include reviewing and advising them on their four main financial planning areas (Business Plan, Wealth Plan, Retirement Plan, and Estate Plan) as part of our scope of services. Keep in mind that value pricing focuses on what your client decerns to be the value of your services, rather than how you perceive the value of your services.

This approach can easily triple or quadruple your revenue as you position yourself at the very top of the Value Curve and command the most profitable price possible for your services. Prospects will actually want to pay higher fees because of the amazing value they will receive. From their point of view, they had someone looking after their most valuable asset – their life.

Key #3: By Positioning Yourself as Your Client’s External CFO, You’ll Receive All the Benefits of the Value Curve – Higher Pay with Fewer Hours and a Greater Perceived Value by Your Clients

Typical Objections With This Pricing Model

Now, it’s about this time when I normally hear three main objections from accountants. They are generally “That sounds great but…”

- I don’t have the expertise to provide the advice necessary for all four planning areas you’ve outlined (or all of the higher value services on the Value Curve)

- My clients won’t pay more for these services (or my clients are already giving me price pushback on what I currently charge them)

- I’ve tried selling these services to my clients and they tell me they already have everything in place and don’t need my involvement.

Let me answer these one at a time.

Not Having the Expertise to Provide Higher Value Services

As for not having the expertise to provide advice on all the services on the Value Curve, I couldn’t agree with you more. Unless someone is a financial prodigy or an incredibly delusional individual, they can’t and shouldn’t provide all the expertise on the Value Curve. No one can!

I’m not suggesting that you provide your clients with advice on where to invest in the market — that’s a job for their financial advisor. Nor would I suggest you advise a client on drafting a will or any other type of legal document — that’s a job for their lawyer. So, just as a general contractor hires out an electrician and a plumber, the same goes for you as the external CFO.

As professional accountants, we already have the expertise needed to review and monitor our client’s plans across the four pillars to ensure they are working together correctly. Simply put, are the plans supporting the client’s life as they want it to be? Your job as the external CFO is to be the overseer and coordinate your clients planning pillars (Business Plan, Wealth Plan, Retirement Plan, and Estate Plan) to make sure all the plans support them effectively. This is a service we can, and should, do for our clients.

Where specific expertise beyond your knowledge is needed, you will seek it out, always maintaining your position as the CFO. You want your client to see you at the control booth steering the conversations and ensuring their planning foundation is built according to their wishes. You already have all the qualifications necessary to handle this role as their external CFO. All you need is to take the initiative, assume this role, and reap the rewards.

My Clients Won’t Pay More…This is a Lie

The reason accountants think their clients won’t pay them more is because they haven’t sold the results of their services properly. Notice I didn’t say “they didn’t sell their services properly.” I said they didn’t sell the results of their services. Accountants often have a lack of confidence when it comes to pricing but this is where the art of selling is so important. To position yourself at the top of the Value Curve, you have to be able to sell the value of the outcomes your client’s experiences.

I could easily write multiple chapters on selling for accountants (and I do a deep dive into this in my Accountants Success Formula™ program), but for now, here are some of the critical keys you need to know.

There is a well-known selling principle that all the top salespeople know:

- People buy first based on emotion

- Then, they rationalize their purchasing decision with logic

As accountants, we tend to sell backwards. We explain the logic of what we do and then expect our clients to buy into it. That’s not how it works.

People’s buying decisions are led by emotion and then they rationalize them with logic. Given our years of training to logically analyze facts and figures, it’s no wonder we put the cart before the horse! Enter the standard sales pitch: “I prepare your financial statements, file your tax returns, and provide you advice as needed.” There’s no emotion there. You need to hit their emotional motivators.

The key to selling is to get to know what’s really important to your client. What is the result that matters most to them? I’m not talking about a surface answer like “minimizing their taxes.” There’s always a deeper underlying motivator. You have to take the time to find out what it is so you can assess the real value of the results. For this, you need to spend time truly getting to know your client before you can sell them your higher-value services.

Once you discover your client’s underlying emotional motivator, you’ve hit gold. Take our example previously about “minimizing their taxes” and dig deeper to find the emotional motivator for this. One client may want to save more money for their child’s college fund, whereas another may want to buy a summer cottage for family vacations, and yet another may want the tax savings for their retirement fund so they can afford to take a dream safari. Each of these reasons hits an emotional chord. Once you show them how the results of your services will satisfy their emotional motivators, you’ll make the sale.

Notice how you can position yourself as the overseer of the client’s life? To do this, you have to get to know what they really wanted for their life and from this knowledge, you could sell them those results. Remember this, it’s important; people don’t really care what you do, they only care about what they will get as a result of what you do.

Find out what they want first, sell to that emotional motivator, and then let them justify their purchasing decision with logic. This approach works every time. And the best part is, your clients will get what they really want, and you will get paid incredibly well for it. It becomes a win-win scenario.

Don’t Believe it When Your Client Says “I Already Have It Covered”

Again, this is another scenario where accountants need to learn how to sell their services to their clients. Let’s take a closer look at our client’s statement, “It’s already taken care of.” The further you dig into understanding what your client’s plans are, the more you will see where those plans are deficient and your financial quarterback services are needed.

The first question to always ask is, “Who has taken care of these plans for you?” In most cases they will say that they had their lawyer handle the estate plan, their financial advisor handles the wealth and retirement plan, and their business advisor handles the business plan. As such, they’re thinking, “Why do I need you to reinvent a wheel that already works?”… But does it?

It is totally logical for our clients to go to these professionals to get their advice on each of their planning areas. They have to. This isn’t the problem. The real problem is that rarely if ever, do these professionals take the time to gain detailed insight into the other planning areas to ensure that their solutions integrate effectively with all the other plans. Too often, by the nature of their engagement with their clients, these professionals (accountants included) work in silos.

How often have you had your clients come to you and mention in passing that they recently redid their wills? Did anyone think to include us, the accountants, in this discussion? Nope. You end up finding out that the wills are missing key tax planning strategies, and you end up having that uncomfortable conversation with your client and their lawyer, telling them that they should amend the wills again. We know how much fun that is.

The same challenges happen with business, wealth, and retirement plans. Even though we might not be aware of it, these plans may have inconsistencies within them. So, who’s making sure that all of these plans are working together correctly to get your clients to where they want to be? Due to the nature of the engagement with each professional advisor, this role tends to fall to the clients themselves. But without any technical knowledge, how will our clients know for certain that the different plans they receive from each advisor is working with the other plans effectively? Most clients don’t even realize that they are the ones who have this role by default.

To be fair, it isn’t our client’s fault that this happens. It’s ours. I know it becomes a finger-pointing exercise to say it’s the other professional’s fault, but it’s really our fault. We need to advise our clients of the problems that can occur with multiple professional plans and no overseer. The client doesn’t even realize they need a quarterback. And no one is better qualified to handle the financial quarterback position for our clients than we are, their accountant.

Be Your Client’s #1 Trusted Advisor

One quick look into the four planning areas and we can easily see where inconsistencies and problems occur. Our professional training, tax knowledge, and financial experience sets us up to be our client’s #1 trusted advisor. All we have to do is step up to the plate and make them aware of the benefits of having us oversee these areas, and most importantly, the cost of not having us fulfill this role. Your clients don’t know what they don’t know. It’s your role to educate them on the value of your Financial Quarterback services and the cost of standing still.

From my experience, it doesn’t matter how wealthy or successful a client is, there are always missing links in their planning pillars. Sometimes this includes not even having a plan in the first place! I acquired a new client who was worth over $50M and didn’t even have an estate plan in place. Another client of mine had a vision for his children to take over his business, yet his corporate share structure was completely offside to allow this to happen. Another client was building a retirement investment portfolio inside a structure that was going to compromise the future sale of her business. And on and on it goes. By being their Financial Quarterback you not only save these clients thousands of dollars you can also help them with something even more valuable to them — their life plan.

Stop Chasing the Money and Use the Effective Value Pricing Model

We’ve seen how the billable hour is truly no longer a fit for today’s accountant in my post here. The market is showing us where the trend is going, and we can see the tsunami of technology coming down on us. It’s now time to secure our new positioning and to negate the effects of the past pains of the billable hour model. It’s time for you to get great, consistent cash flow while capturing the maximum value we’re providing our clients. Stop chasing the money.

The main driver of value-based billing is a monthly subscription price as opposed to a billable hour method of charging for services. Bundle all your services together, provide your client unlimited access to call you if and when they need it, and lock it up with a monthly price.

The monthly amount is agreed to during the sales conversation with your prospective client. This naturally forces the conversation to turn to the perceived value of what you’re providing, along with a mutual agreement as to the price that is to be paid in light of that perceived value.

One of the great things that comes from this method of billing is that it will make you better at selling your services. It requires you to dig deep into what your clients really want as a result of your services so that you can get your price in alignment with the value they’re going to receive.

A monthly subscription model is what consumers love. We know this as we’ve seen the biggest companies in the world moving to it (Apple, Canva, GoPro, Slack, and even Volvo just to name a few). It removes all surprises and stressors for them. They know exactly what they are going to pay for the service you’re performing, it provides them the freedom to call you when they need you, and it gives them a smoothing of their own cash flow. Clients love this model!

More importantly, accountants love this pricing model as well:

- No more time sheets (goodbye WIP reports)

- No more stressing about what to bill after the fact

- No more client pushback on fees after you’ve done the work

- No more asking the client permission to pay for what you’ve already done

- No more chasing outstanding A/R

- No more inconsistent cash flow

- No more capital requirements to support WIP & A/R

Another wonderful bi-product is the effect this has on your practice valuation. Cash flow is everything in business, and your predictable, consistent cash-flow model will pay huge dividends when you go to exit your practice.

Everybody wins. Every time one of my coaching clients adopts this updated model, they greatly increase their cash flow, profitability, and overall sense of peace and enjoyment in their practices. The billable hour model is like a monkey on our back. It’s not until it’s gone that you feel the relief come off your shoulders. Damn monkeys!

Value Pricing – Key to a Profitable & Sustainable Business Model For Your Accounting Business

The Accounting Profession is going to see major disruption in the very near future. Value Pricing is key to moving toward a profitable business model in your Accounting Business.

Three major results occur from moving up the Value Curve and Using the Value Pricing Model:

KEY #1: You maximize your earnings per client by providing services higher up the Value Curve.

KEY #2: You protect yourself from the first wave of AI disruption by selling services higher up the Value Curve.

KEY #3: You receive all the benefits of the Value Curve — higher pay with fewer hours and greater perceived value — by positioning yourself as your client’s external CFO.

Shifting your accounting practice from a compliance-based firm to a reliance-based firm takes focused attention. It takes a willingness to let go of what no longer serves you. It takes a commitment to step outside your comfort zone.

In the end, it is 100% worth it to make this shift – this I can promise. I guarantee that you will be richly rewarded with increased profits, fewer work hours, greater fulfillment, and more peace of mind – isn’t that what we all want!

[…] You won’t hear this from me often, but if you love bookkeeping, then you should focus on bookkeeping. If you want to do personal tax returns, then focus on that. You should place your focus on what you enjoy doing the most. *Keep in mind that over time, technology and AI will make these roles obsolete (see my blog post here for more info). […]